The financial landscape for retirees across America is far from uniform, with factors like earning potential and housing costs varying widely from city to city. Location is a critical piece of the puzzle when it comes to living a healthy financial life, and ultimately, for achieving a financially secure retirement.

But which U.S. cities foster financial security for their senior residents?

To get to the bottom of this question, we performed a comprehensive analysis of 170 U.S. cities with populations exceeding 150,000. Using U.S. Census Bureau data, eight key variables were weighted and compared, including senior poverty rates, homeownership rates, mortgage status, reliance on food stamps, private retirement income, and household earnings. The result is a ranking of cities across America where retirees can find the greatest level of financial resilience in their golden years.

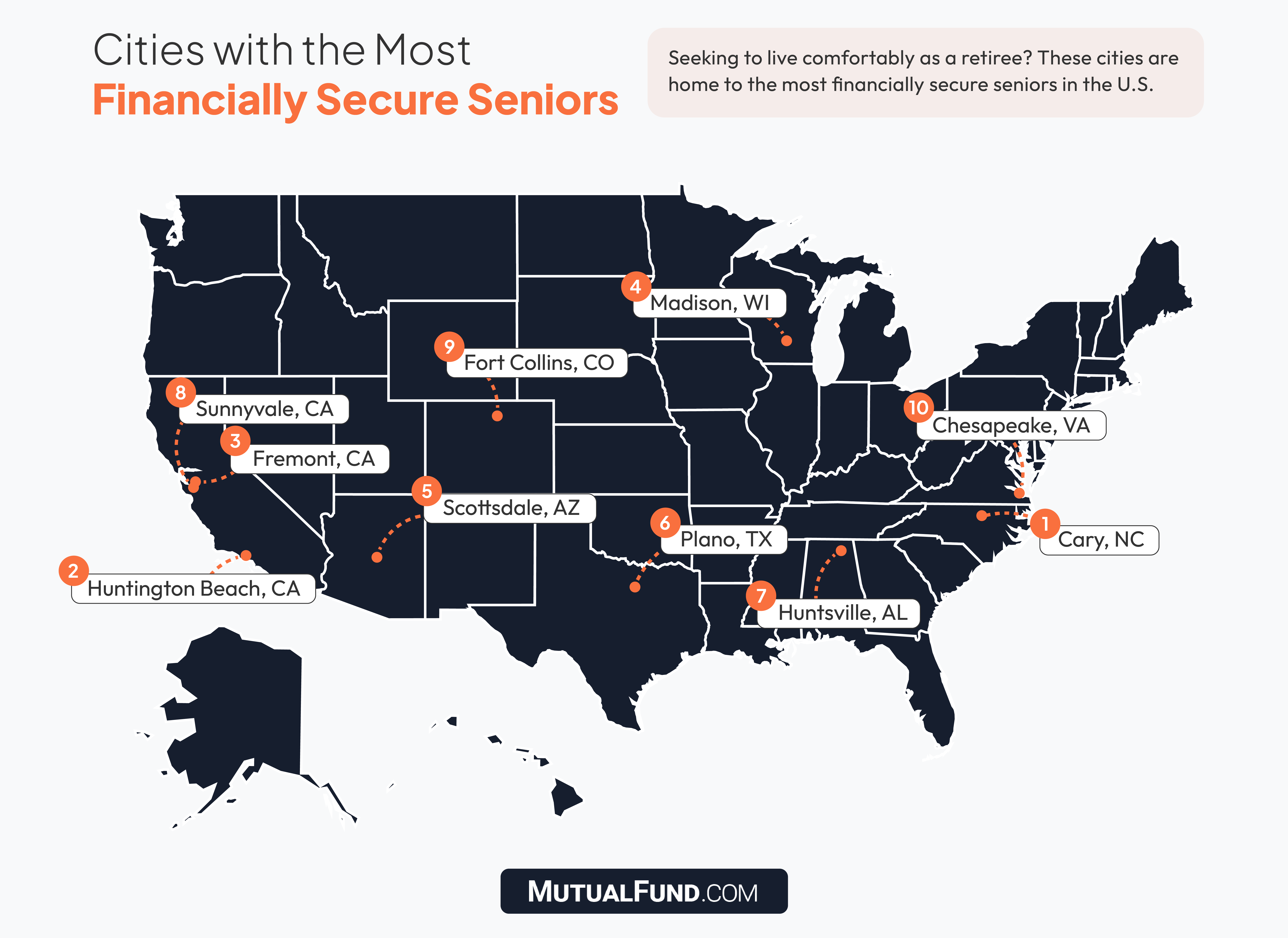

Charming Cary, North Carolina tops our list of the most financially secure retirement havens. Here, an impressive 71.2% of seniors enjoy the security of private retirement income and only 19.9% of senior homeowners in Cary find themselves burdened by the cost of housing payments.

While California often carries a reputation for its high cost of living, Huntington Beach and Fremont, CA rank 2nd and 3rd, respectively, among the nation's best locations for a financially healthy retirement. Retirees In Huntington Beach bring in the 6th highest mean retirement income in the nation ($48,763), and Fremont ranks 8th in mean household retirement income nationwide ($46,263), defraying some of the costs of living in prime real estate zones.

Heading inland, Madison, WI (No. 4 overall) mirrors Cary in its high percentage of seniors declaring private retirement income (70.0%), and Scottsdale, AZ (No. 5) boasts the 6th highest mean household earnings for seniors in the nation ($110,432).

The remaining top 10 cities, including Plano, TX (No. 6), Huntsville, AL (No. 7), Sunnyvale, CA (No. 8), Fort Collins, CO (No. 9), and Chesapeake, VA (No. 10) feature a combination of low senior poverty rates, high retirement incomes, and generally low percentages of cost-burdened senior homeowners.